Entertainment: The Fandom Economy: Anime and Legacy Franchises Dominate the Box Office, Signaling a New Era of Viewer Loyalty

- InsightTrendsWorld

- Sep 17, 2025

- 9 min read

What is the "Fandom Economy" Trend?

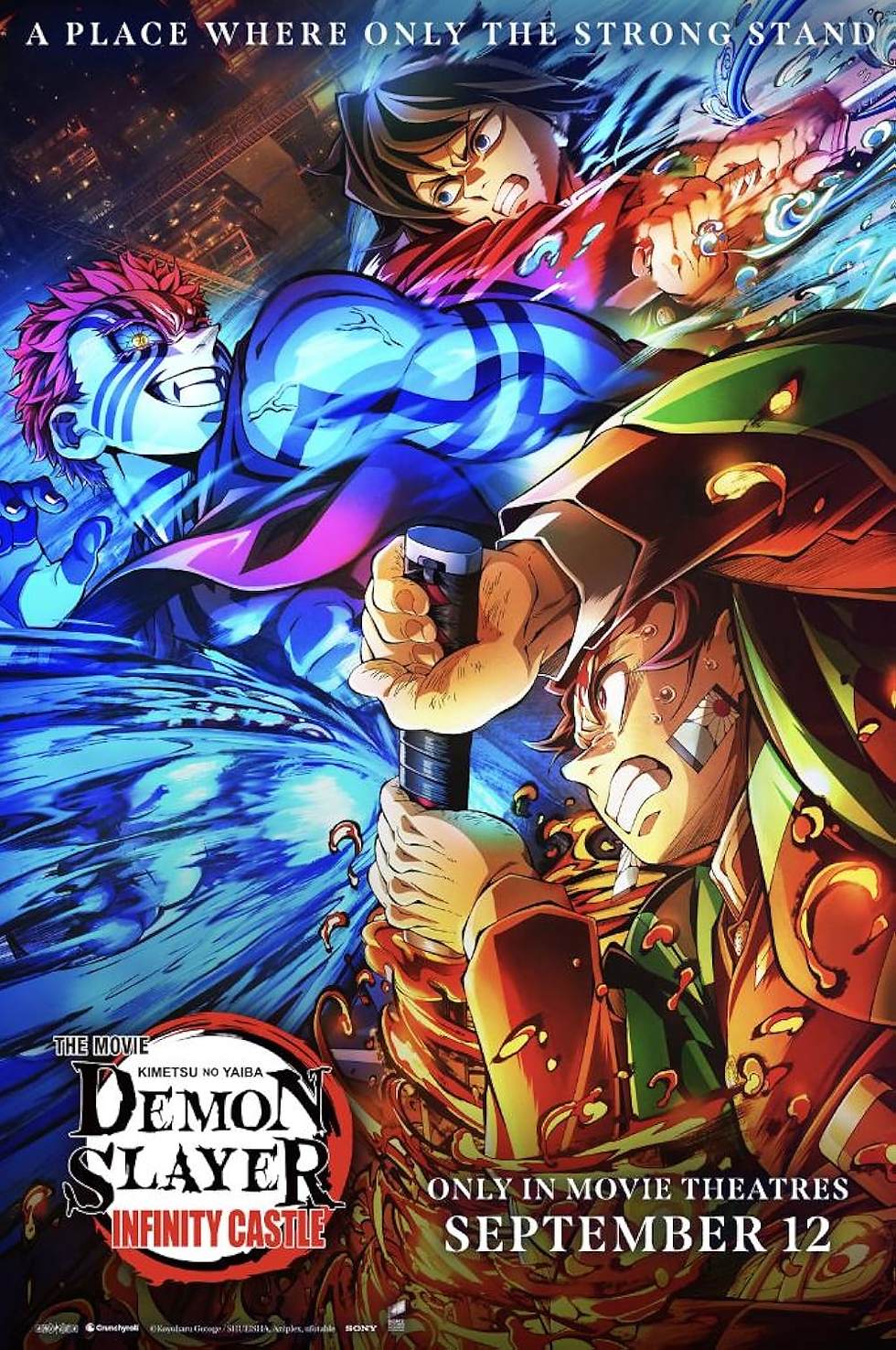

Targeted Blockbusters. This trend is the new reality of the theatrical market, where films with pre-existing, highly dedicated fanbases are outperforming general-audience blockbusters. The success of a Japanese-language anime film, Demon Slayer, at the number one spot highlights a global shift in consumer power.

The Power of Proven IP. The top-performing films are almost all sequels, franchises, or re-releases. This demonstrates that audiences are choosing to spend their money on familiar and trusted content, from the finale of a beloved series like Downton Abbey to the 30th-anniversary re-release of Toy Story.

Event-Based Viewing. Moviegoing is evolving from a casual activity to a planned event. High grosses for special screenings of classic films and concert documentaries show that people are willing to pay for a communal, nostalgic, and unique theatrical experience.

Why it is the topic trending: The Unpredictability of Success

An unexpected champion. The trend is a topic of conversation because a Japanese anime film has not only topped the domestic box office but has done so with a massive lead, grossing more than double the daily earnings of the number two film, The Conjuring: Last Rites. This challenges the traditional dominance of Hollywood-produced content.

The nostalgic pull. The strong performance of re-releases like Toy Story, Hamilton, and The Sound of Music is a clear signal that nostalgia is a powerful motivator for consumers and a reliable revenue stream for studios.

A global marketplace. The success of Demon Slayer in the North American market highlights the increasing interconnectedness of global media. A film's success is no longer tied to its country of origin but to its ability to mobilize a passionate, worldwide fanbase.

Overview: A New Box Office Order The domestic box office for September 14, 2025, was a clear demonstration of the "Fandom Economy" in action. The top spot was claimed by the Japanese anime film Demon Slayer: Kimetsu no Yaiba - Infinity Castle with a commanding daily gross of over $16 million. This strong performance, along with the continued success of franchise films like The Conjuring: Last Rites and Downton Abbey: The Grand Finale, and a host of popular re-releases, showcases a market that is increasingly driven by highly engaged and loyal audiences.

Detailed findings: The Data-Backed Disconnect

Demon Slayer: Kimetsu no Yaiba - Infinity Castle: The film debuted at No. 1 with a daily gross of $16,015,917. After only three days in release, it has already amassed a total of over $70 million, highlighting its explosive popularity and a record-breaking opening weekend for an anime film.

The Conjuring: Last Rites: In its second week, the horror sequel held a strong second-place position, adding $6.8 million to its cumulative total of over $130 million.

Downton Abbey: The Grand Finale: The final installment of the beloved British franchise landed at No. 3, earning over $4 million on its third day, bringing its domestic total to over $18 million.

The Re-release Phenomenon: Several re-releases performed impressively, including the 30th-anniversary screening of Toy Story ($954,298), the Hamilton re-release ($734,291), and the 60th-anniversary presentation of The Sound of Music ($675,035).

Key success factors of the trend: Formulaic Comfort

Leveraging a built-in fanbase. The success of Demon Slayer is a direct result of its massive and loyal following from the anime and manga series. Its fans showed up in droves for the theatrical experience, treating it as a cinematic event.

The enduring appeal of franchises. The data for The Conjuring, Downton Abbey, and The Bad Guys 2 shows that audiences are drawn to familiar stories and characters. These sequels offer a safe, reliable entertainment choice.

Nostalgia as a revenue driver. The impressive numbers for Toy Story and The Sound of Music prove that audiences are willing to pay for a nostalgic experience, especially when it's framed as a limited-time, anniversary event.

The value of the "event." Films like The Sound of Music and Hamilton are not just movies; they are communal experiences. Distributors are successfully turning a cinema visit into a special occasion that motivates ticket sales.

Key Takeaway: The Box Office Is a Market of Niches The core takeaway is that the domestic box office is no longer a one-size-fits-all marketplace. A diverse range of films, from niche international titles to familiar legacy franchises and nostalgic re-releases, can all find significant success by appealing to their own unique and passionate fanbases. This weekend's results prove that a film's "mainstream" appeal is a secondary concern to its ability to deeply engage a targeted audience.

Main trend: The "Event-Based Cinema" Model This trend describes a new strategic approach to film distribution and exhibition where films are marketed and released not just as movies, but as high-value, communal events, often with limited-time engagements. This model is thriving on the power of pre-existing fanbases and a sense of occasion.

Description of the trend: The New Measure of Success The "Event-Based Cinema" model represents a shift in how studios and exhibitors are generating revenue. Instead of relying on a steady, weeks-long theatrical run for all films, this model prioritizes a powerful opening weekend driven by a dedicated audience. It is characterized by high grosses for specialized content—such as anime, concert films, and anniversary re-releases—that are designed to draw viewers out of their homes for a unique and time-sensitive viewing experience.

Key Characteristics of the Core trend:

High Opening Weekend Dominance: A film's success is increasingly judged by its first few days in release, particularly if it has a large, pre-existing fanbase.

High Per-Theater Average: Niche films and event-based content often have a very high per-theater average, indicating that the audience who shows up is a committed one.

The Rise of Non-Traditional Content: The top 10 is increasingly populated by films that are not typical Hollywood blockbusters, from animated features from Japan to filmed stage productions and classic re-releases.

A "Fandom First" Mentality: Marketing and distribution strategies are designed to appeal directly to a film's core fanbase, often through social media and fan communities.

Market and Cultural Signals Supporting the Trend: The Demise of the Monolithic Review

The box office chart itself: The diverse list of top-performing films, from a Japanese animated film to a British period drama and an American musical, is the clearest signal of a fragmented, fan-driven market.

The success of re-releases: The strong performance of films like Toy Story and The Sound of Music, which are widely available on streaming platforms, signals that the cinematic experience itself, driven by nostalgia and community, has a value beyond the content alone.

The dominance of global IP: Demon Slayer's success in the domestic market is a powerful cultural signal that American audiences are more receptive than ever to international content, especially from major franchises.

What is consumer motivation: The Need for Shared Experiences

For a sense of belonging: Consumers are motivated by the desire to share an experience with other fans, celebrating a beloved franchise on the big screen.

For nostalgia: The audience for films like Toy Story and The Sound of Music is driven by a deep sense of nostalgia and the emotional pull of returning to a familiar story.

For trusted entertainment: In a crowded media landscape, consumers are motivated to pay for films that are part of a trusted brand or franchise, knowing that they will likely be entertained.

What is motivation beyond the trend: The Challenge to Authority

A rejection of homogenous content: By supporting niche films and non-traditional content, consumers are sending a clear message to studios that they are tired of a predictable, blockbuster-only diet.

A celebration of diversity: The audience is motivated by a desire to support a diverse range of stories, from different cultures and eras, that may not have been given a chance in a previous era of Hollywood.

To be part of a movement: The success of a film like Demon Slayer is a phenomenon driven by a massive, organized, and digitally-native fanbase that views their support as a form of cultural expression.

Descriptions of consumers: The Dedicated Fanbase

Consumer Summary: This new consumer is not a single demographic but a collection of highly motivated, media-savvy fans. They are loyal to specific genres, franchises, and even directors. They are more likely to track box office numbers and engage with fan communities online.

Who are them: The Demon Slayer consumer is a global fan of anime and manga, likely to be digitally native. The Downton Abbey consumer is a dedicated fan of the series. The re-release consumer is nostalgic and values the shared cinematic experience.

What is their age?: The consumer base is highly varied, from the younger fans of Demon Slayer to the older demographic that grew up with The Sound of Music.

What is their gender?: Not specified, but fanbases for each film are likely to have their own gender breakdown.

What is their lifestyle: They are passionate about their interests and are willing to pay for premium, event-based entertainment that caters to them.

How the Trend Is Changing Consumer Behavior: From Passive to Curated Consumption

From "casual moviegoer" to "event participant": Consumers are increasingly making a conscious decision to go to a movie theater for a specific film, rather than just for a general night out.

Prioritizing event over availability: The success of re-releases shows that consumers are willing to pay for a film they can watch for free at home, because the theatrical experience is the primary motivator.

The "front-loading" of attendance: Consumers are driven to see a film on opening weekend to be part of the initial wave of social media conversation and shared experience.

Implications of trend Across the Ecosystem: The New Value Proposition

For Studios and Distributors: The value of a strong, pre-existing fanbase is at an all-time high. Studios will prioritize developing IP that has a built-in audience, regardless of its origin.

For Exhibitors: The rise of "event-based" films provides a more reliable revenue stream and justifies investing in premium cinema experiences like IMAX and Dolby Cinema.

For Brands and CPGs: The trend offers new opportunities for highly targeted marketing campaigns aimed at specific fan communities, as a film's success is now concentrated in a more predictable demographic.

Strategic Forecast: The Future of Formulaic Success

More cinematic adaptations of non-traditional IP: Expect to see more anime films, video game adaptations, and filmed stage productions on the big screen.

The normalization of re-releases: The "anniversary re-release" will become a standard part of a studio's distribution strategy for popular older films.

New data-driven marketing models: Studios will use social media and consumer data to better identify and cater to the specific needs of a film's fanbase, leading to more tailored and effective marketing.

Areas of innovation: The New Metrics of Success

Personalized "Event Calendars": Streaming platforms and ticket retailers could offer personalized "event calendars" to users, notifying them when a special screening of a film they love is happening.

Interactive Fan Screenings: The creation of screenings that incorporate fan-favorite elements, such as cosplay contests, themed refreshments, or live Q&As with the creators.

"Franchise Passport" Subscriptions: A subscription model where a dedicated fan can pay a fee to get early access and special perks for all films within a specific franchise.

"Nostalgia-as-a-Service" Platforms: New services that specialize in curating and marketing event-based re-releases and anniversary screenings.

Predictive "Fandom-Power" Analytics: The use of AI to analyze social media sentiment and online engagement to predict the box office success of a film with a pre-existing fanbase, providing a more accurate metric than traditional polling.

Summary of Trends:

Core Consumer Trend: From broad appeal to niche loyalty. Consumers are moving away from general blockbusters and toward films that cater to their specific interests and fanbases.

Core Social Trend: The democratization of the box office. The success of a Japanese anime film proves that the box office is no longer solely a reflection of American pop culture, but a global and fragmented market.

Core Strategy: The primacy of proven IP. Studios are prioritizing films with established franchises, sequels, and beloved back catalogs as a reliable way to generate revenue.

Core Industry Trend: The "event" is the product. The primary value of a theatrical release is shifting from the content itself to the unique, communal, and time-sensitive experience it offers.

Core Consumer Motivation: The desire for belonging and nostalgia. Consumers are motivated by the chance to share a meaningful experience with a like-minded community.

Final Thought: The New Rules of the Game The domestic box office data is a powerful snapshot of a market in flux. It tells a clear story: the rules have changed. The top spot is not held by a sprawling Hollywood epic but by a specialized anime film that commands the loyalty of its dedicated fanbase. The rest of the chart is filled with sequels and re-releases, a testament to the fact that audiences are placing their bets on what they know and love. In this new era, the ticket is not just for a movie—it's for an event, a shared experience, and a declaration of fandom. This trend has profound implications for every player in the industry, from the largest studio to the smallest independent cinema, as they all must now cater to the power and passion of the "fandom economy."

شيخ روحاني

رقم شيخ روحاني

شيخ روحاني لجلب الحبيب

الشيخ الروحاني

الشيخ الروحاني

شيخ روحاني سعودي

رقم شيخ روحاني

شيخ روحاني مضمون

Berlinintim

Berlin Intim

جلب الحبيب

https://www.eljnoub.com/

https://hurenberlin.com/

youtube

Classic board games continue to thrive in digital spaces, reaching new generations of players. Online platforms like https://247-backgammon.pissedconsumer.com/review.html show how timeless games such as backgammon can be played anytime, anywhere, connecting people globally. For enthusiasts, these platforms provide an easy way to practice strategy, compete against friends, or challenge strangers. The digital format preserves the essence of the original game while making it far more accessible.